Amalgamated leads US banks on the road to sustainability

Amalgamated Bank shows the route. "Many US companies address climate change and major financial institutions are beginning down our journey" says CEO

Amalgamated Bank is definitely not an ordinary financial institution. Founded almost a century ago, the New York based bank has survived many adversities over the years: from the Great Depression to the last financial crisis, when it nearly failed as it was forced to write off $150 million in subprime loans. Keith Mestrich joined the bank in 2012 and he is currently its President & CEO. Since the beginning of the financial crisis, however, many things have changed. Now Amalgamated – which is also a member of GABV (Global Alliance for Banking on Values) – holds over $5 billion in assets and nearly $50 billion in custody and investment assets under management. Moreover, the financial institution provides retirement securities to millions of American workers and uses its voice as a shareholder to hold other companies accountable.

Today, the different approach that some banks and firms are starting to show is probably the greatest reason of satisfaction. In the USA we finally see important commitments by companies, Mestrich tells to Valori. Amalgamated’s doctrine on climate change and social responsibility, in other words, really seems to lead the way.

Approfondimento

Finanza etica coast to coast

Amalgamated Bank, storico istituto newyorchese di ispirazione sociale, si espande in California. Una nuova opportunità per l’azionariato attivo USA

Mr Mestrich, do you think that financial institutions like Amalgamated Bank or GABV members can also inspire traditional banks to change their practices and policies?

Absolutely. Amalgamated Bank aims to be a beacon for our industry, and for other public companies, as to how you can make a positive difference in society – and in fact, that we have a responsibility to do so. We’re heartened to see that some other major financial institutions are starting to wake up to this and are beginning down the journey that our bank has been on for some time – for example, BlackRock’s recent announcement on climate change. That said, there is so much more to be done and we will always strive to lead our industry in developing and implementing more sustainable and responsible practices. We regularly lead working groups and collaborate on industry-wide initiatives to that end.

Approfondimento

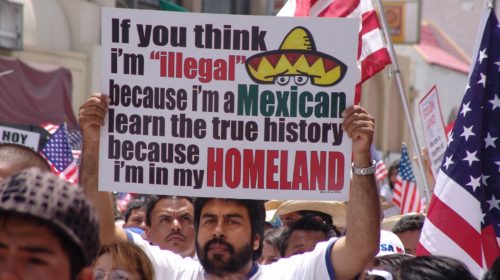

Immigrati: le banche USA abbandonano le carceri private

Bank of America taglia per scelta "etica" i fondi alle carceri private che "ospitano" immigrati e detenuti. Un business miliardario travolto da enormi polemiche

Global responsible investments are growing steadily. Do you think this could also lead to a greater use of greenwashing practices by corporations?

There is a risk of this; it has become increasingly in vogue for companies (including financial institutions) to tout their “green” credentials without taking on the fundamental changes that are needed. That is why it is important that as a financial institution we regularly advocate with companies we are invested in to ensure they are held accountable and are enacting appropriate measures like disclosing climate risk and committing to science-based targets. With all that said, there are many, many companies out there who are doing the real work of addressing climate change – including many of Amalgamated’s own clients. So we are optimistic that the commitments we are seeing from companies are not just talk but will lead to action.

How is your corporate engagement activity going? What kind of initiatives do you have in agenda for 2020?

Amalgamated Bank has continued to exercise its corporate voice on the social and political challenges facing Americans. Most recently, we have come out in support of Everytown’s gun safety pledge, stopping the state bans on reproductive rights, supported paid sick and family leave policies, and was the first US bank to endorse the UN’s Principles for Responsible Banking. In addition, we continue to conduct shareholder activism on behalf of workers’ rights and sustainability issues.

Approfondimento

Azionariato attivo e azionariato critico. Cosa sono e in cosa sono diversi

Etica Sgr e la Fondazione Finanza Etica affrontano la stagione delle assemblee: da A2A a Campari a Telefonica. Da Eni a Enel a Leonardo

How do you judge the Economic Growth, Regulatory Relief, and Consumer Protection Act passed by the Congress in 2018 that rolled back significant portions of the Dodd-Frank Act?

Amalgamated Bank has historically been a supporter of the Dodd-Frank Act because we believe it is critical to ensure consumers are protected and the financial sector fulfils its duty to be a productive member of the American and global economy.

Which reforms do you think are the most urgent in order to ensure a better regulation of the financial system? What would you ask the next US President to do on this issue?

We continue to advocate for fair regulations of banks, particularly within our peer group, so that the standards regulators hold us to also allow us to have deeper community impact. The Community Reinvestment Act (The 1977 law requiring the Fed and other regulators to encourage banks to help meet the credit needs of the local including low- and moderate-income areas, Editor’s note) is currently under review and we are watching that process closely.